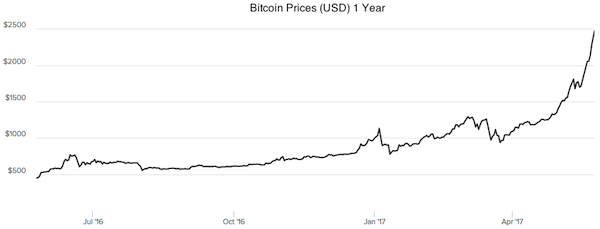

A textbook bubble in Bitcoin prices is developing right now.

And it has everything to do with Bitcoin's investors.

I'm probably not going to gain any friends

with this perspective. But there are inarguable factors that suggest

Bitcoin's own buyers are irrationally driving up prices. And their

exuberance is setting the market up for a crash.

The Secret Gold Market They're NOT Telling You About

This hidden playground is completely OFF LIMITS to retail investors...

But it holds a secret that can help you predict spikes in gold with mysteriously uncanny accuracy...

Here's how you can piggyback off it for gains of 468%, 935%, 1,657%, and more...

Click here now for full details.

|

Let me clear one thing up about Bitcoin before I explain why I think prices are eventually headed for a crash...

As I argued before, Bitcoin is a legitimate form of money. But for the time being, it's being treated as a speculative investment.

Money is typically used in exchange. And while Bitcoin can

be used in exchange, it's largely not. Gary Schneider, Professor of

Accounting at California State University, says only about 10% of

Bitcoin is held by people who use it as currency. The large majority are

speculators hoping to sell at higher prices.

The fact that the market is dominated by

speculators is not necessarily the problem for Bitcoin. And here's where

I'm sure to piss some people off... The problem for Bitcoin is its

buyers.

Who are they?

Well, according to a recent survey, approximately 60% of Bitcoin owners are under 35 years old.

In short, most Bitcoin buyers are

millennials. And that's all we need to know about them to make an

inarguable point (told you I wouldn't be making any friends here).

The fact is this: A 35-year-old speculator

intrinsically has much less experience in risk management than a

60-year-old. And remember, most Bitcoin owners are mostly speculators,

as opposed to users of the product.

AND remember they're speculating on a currency, which is among the most volatile of financial instruments.

AND remember they're speculating on what essentially amounts to a new, experimental currency.

All this considered, Bitcoin looks to me as one of the (if not the) most speculative financial instruments available...

Expect for Bitcoin's derivatives, of course.

Yes, believe it or not, Bitcoin has a

futures market. And there are products that offer even more risk. On its

Perpetual Bitcoin/USD Swap Contracts, BitMEX offers up to 100x

leverage!

But to really understand why I think

Bitcoin is eventually headed for a crash, let's consider the most famous

market bubble in history...

Dutch Tulip Mania

In the 17th century, formal

futures markets developed in the Dutch Republic, providing the

infrastructure for a massive bubble in the price of tulip bulbs.

The tulip first became fashionable in

France, where early modern ladies of the aristocracy began sporting the

flower on their dresses. From there, the tulip became the flower to show

off social status and wealth. The demand for bulbs subsequently

skyrocketed, and prices immediately followed.

At the peak of Tulip Mania in 1637, a

single tulip bulb could cost as much as 10,000 gilders, the price of a

nice middle-class townhouse in Amsterdam. According to one author, 12

acres of land was once offered for one rare bulb. For a flower bulb!

The Semper Augustus was the most coveted of all Dutch tulips.

The Semper Augustus was the most coveted of all Dutch tulips.

Of course, the bubble eventually burst. The

price of tulip bulbs collapsed, and fortunes in perceived value

disappeared over night.

My team of researchers recently uncovered a key patent that exposes a major chink in Tesla’s armor...

This patent describes a groundbreaking

technology that could simply blow Elon Musk, and frankly the entire

solar industry, out of the water.

We’ve managed to uncover the tiny company

with exclusive rights to this technology. It trades at less than $0.15 a

share, but don’t expect it to stay there for long.

Over the next several years, I believe the value of this firm could absolutely explode... by my calculations, upwards of 4,600%.

I’ve included the patent filing and everything you need to know about this small company in this brief, free video presentation.

|

Here's what I really want you to take away from this story...

If we consider whom the people were who

took part in Dutch Tulip Mania and compare them to the majority of

Bitcoin owners, it seems both groups share the same shortcomings.

First, we know both groups are speculators

betting on the hot new product. But I think we can also make good

assumptions to compare the investment sophistication of the Dutch tulip

investors and today's Bitcoin buyers.

Because formal futures markets were only

recently developed, the Dutch tulip buyers were inherently

unsophisticated investors. All of them. They simply didn't have the

experience.

The majority of today's Bitcoin buyers are

generally younger, so they share the same inexperience. For many Bitcoin

buyers, I imagine it represents their first real investment. They

simply don't have experience in risk management. And I think that's

pretty clear considering some are buying products with 100x leverage!

Bitcoin could be the tulip of the 21st

century with the development of a textbook bubble. And I think could be

setting itself up for an eventual crash.

Now, even though I've been talking about a

crash in Bitcoin prices, there's an epilogue to the Dutch tulip story

that's often overlooked... and that actually provides a bullish outlook for the technology.

Truth is, the Dutch tulip bubble never

really ended... it evolved. The price of tulip bulbs collapsed in the

17th century. But the flower industry at large eventually recovered and

has never been bigger. Global floral production value is currently

estimated at $55 billion.

People still pay thousands for rare

flowers. In fact, an anonymous buyer paid over $200,000 for a rare

orchid in 2005. And that's not even considered the most expensive flower

in the world. Rose breeder David Austin spent 15 years and $5 million

to develop Juliet rose.

My point is, the tulip as an individual

product lost favor. But the collapse of the tulip market didn't

completely kill the flower market. In the same way, I don't expect a

collapse of Bitcoin prices to completely kill the blockchain-based

currency market.

Bitcoin is simply one product of many blockchain-based currencies. A crash in Bitcoin would throw a wrench in the blockchain-based revolution. But there is little doubt that blockchain technologies are the future.

As we speak, every major central bank and

large financial institution is researching how to implement blockchain

into its own systems. It has already been proven to eliminate

verification redundancies and improve security, and new applications are

being tested every day.

So while I think Bitcoin itself could

eventually be headed for a crash, the blockchain technologies that are

supporting all these digital currencies seem set for unprecedented

growth.

Until next time,

Luke Burgess

Related Links:

Related posts:

A collection of bitcoin

tokens. Bloomberg—Bloomberg via Getty Images Digital

currencies rally, but caut...

With the inclusion of the two investment schemes run by a company

with international investors, there are now 302 firms in Bank

Negara’s...