;

China's Xi Jinping Congratulates US President-Elect Donald Trump, Calls for "Win-win Cooperation"

We have noticed that President Xi's congratulatory message has received widespread attention and reports from international community. Phrases such as "China and the US must live in harmony in the new era," "Hopefully China and the US can find a way to get along" and "China and the US must live in harmony and manage differences" have become the themes of many media reports, fully reflecting the world's expectation for China-US relations. After the dust settled from the US elections, amidst the world's many concerns and worries regarding China-US relations, China's attitude undoubtedly provides valuable certainty and stability for both China-US relations and the world.

Where are China and the US headed? The Chinese side's answer to this question, including its attitude toward China-US relations, has been consistent. Although the situations of both countries and their relationship have undergone significant changes, China's commitment to the goal of a stable, healthy and sustainable China-US relationship remains unchanged; its principle in handling the relationship based on mutual respect, peaceful coexistence and win-win cooperation remains unchanged; its position of firmly safeguarding the country's sovereignty, security and development interests remains unchanged; and its efforts to carry forward the traditional friendship between the Chinese and American people remain unchanged. The four "unchanged" aspects reflect both strategic clarity and a sense of responsibility.

History and reality have repeatedly proven that China-US relations are not a zero-sum game in which one side loses and the other wins, or one rises and the other falls, because the two countries have enormous common interests. Forty-five years ago, it was the common interests that allowed China and the US to open the door of interaction that had been frozen for decades. By tapping into complementarity and drawing on each other's strengths, the two countries have significantly promoted the development of their respective economies and optimized and upgraded their industrial structures, while enhancing the efficiency and benefits of the global value chain. Today, China is one of the top three export markets for 32 US states, with more than 70,000 US companies investing and establishing businesses in China and 930,000 jobs in the US supported by exports to China alone. It can be seen that both China and the US have benefited from decades of generally stable bilateral relations, and it is in the two countries' mutual and fundamental interest to prevent conflict and confrontation and achieve peaceful coexistence.

China-US relations are not a multiple-choice question involving whether or not to do a good job, but a must-answer question on how to do a good job. Just as President Xi stressed, when China and the US work together, they can accomplish a great deal for the good of both countries and the world at large. There are many "cooperation common denominators" between China and the US. After the Chinese giant pandas Yaya and Lele arrived in the US, the number of visitors to the Memphis Zoo surged 46 percent. Last month, Baoli and Qingbao going to Washington caused quite a sensation; Tesla's win-win story of building a factory in Shanghai is still continuing; there is still ample room for cooperation between the two sides in trade, education, anti-drugs, justice, technology and other fields. In the face of a complex and intertwined international situation, the world looks to China and the US to lead international cooperation in addressing global issues. Countries around the world need to unite and collaborate, rather than divide and confront; the people of the world hope for openness and progress, rather than closure and regression.

China-US relations have weathered many storms over the past few decades, during which numerous pessimistic predictions have emerged. However, what people have actually seen is that whenever difficulties arise, it is cooperation - not confrontation - that resolves the issues. What pushes the relationship between the two countries as well as global peace and development to move forward is always win-win cooperation for mutual benefit rather than a zero-sum game. For China and the US, dialogue is better than confrontation, cooperation is better than decoupling, and stability is better than volatility. Regardless of changes in US domestic politics, this should be a shared consensus between both sides and a responsibility of these two major countries. China and the US must find the right way to coexist, as the fundamental lesson in the development of relations between the two countries is that we both stand to gain from cooperation and lose from confrontation.

The US side needs to recognize that China also has the right to develop. China's development is an opportunity for the US and the world, not a challenge. In fact, it has been proven that engaging in trade wars, industrial wars, and technological wars yields no winners. Attempting to solve problems through "decoupling" will only lead to opposite results. Forcing countries around the world to "choose sides" between China and the US has become an increasingly unpopular "multiple-choice question" for many nations. The US, in particular, should not tread on China's red lines regarding issues of sovereignty, security, and development interests.

The China-US relationship is the most important bilateral relationship in the world. How China and the US interact will determine the future and destiny of humanity. We hope that the US side will meet the Chinese side halfway to find the right way for two different civilizations, systems, and paths to coexist peacefully and develop together on this planet, promoting stability in China-US relations and striving for improvement and progress on this basis.

President Xi Jinping has congratulated President-Elect of the US Donald Trump, said Chinese Foreign Ministry spokesperson Mao Ning at a regular press conference on Thursday.

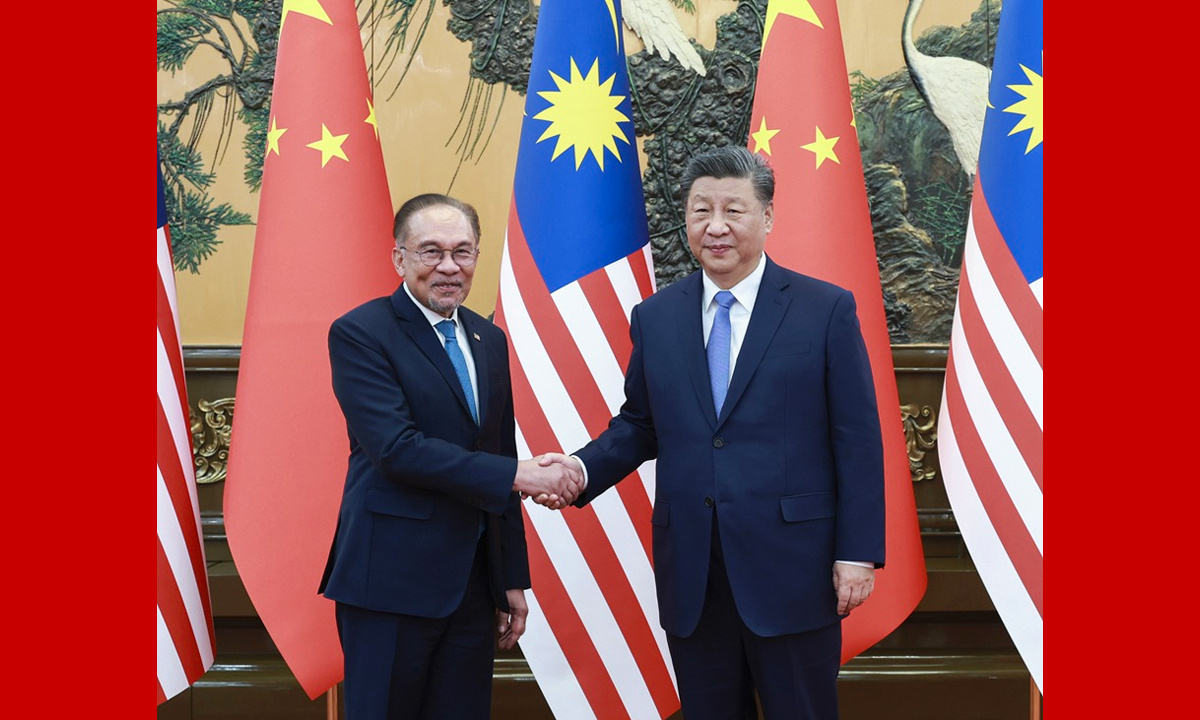

Chinese President Xi Jinping met with Prime Minister of Malaysia Anwar Ibrahim in Beijing on Thursday, calling on the two ...