Panic In Washington – Treasury Secretary Calls Top Bankers To Check Liquidity, While On Vacation

https://www.bloomberg.com/news/videos/2018-12-24/trump-should-have-vetted-jay-powell-wizman-says-video

The final week of 2018 could prove tumultuous for investors as holiday-thinned trading combines with a growing array of pressures on markets.

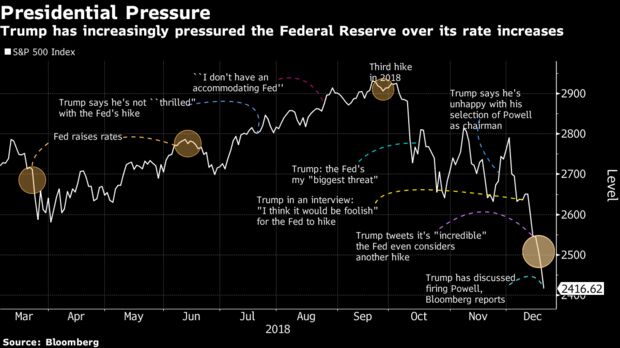

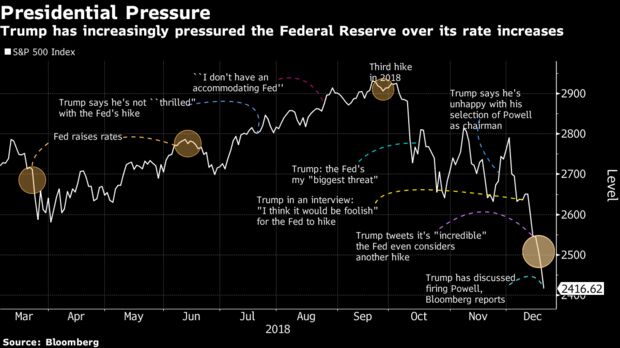

Traders in the $5.1 trillion-a-day currency market were among the first to respond to a partial U.S. government shutdown and a report that President Donald Trump has discussed firing Federal Reserve Chairman Jerome Powell. The dollar slipped against its Group-of-10 peers, while the yen, seen by many as a haven, gained for a seventh day.

Treasury futures climbed in early Asian hours before paring their advance. Cash bonds trading was shut in Asia due to a holiday in Japan, the first in a week that will see a number of closures across major markets.

Sentiment in global financial markets has already taken a beating with the S&P 500 Index just recording its worst week in seven years. Increased uncertainty over the leadership of the Fed could add to turmoil along with a partial shutdown of the U.S. government, although assurances from U.S. Treasury Steven Mnuchin about liquidity and the future of the central bank chief may ease some concerns.

The Treasuries yield curve last week moved closer than ever to its first post-crisis inversion and the rally in safer assets dragged the 10-year yield below 2.75 percent for the first time since April. However, given that much of the upheaval is emanating from the U.S., it is not entirely clear whether Treasuries, and also the U.S. dollar, will act as reliable havens should Powell’s leadership face a genuine threat.

Societe Generale SA’s head of U.S. rates strategy Subadra Rajappa said she thinks a change in Fed leadership is “extremely unlikely,” though she’s not ruling out the possibility of the president persuading Powell to “resign.”

“If it comes to that, given the backdrop of the recent government shutdown, investors might be less inclined to treat Treasuries as safe haven assets,” she said by email. “A change in Fed leadership will likely rattle the already-fragile financial markets and further tighten financial conditions.”

Market participants are generally of the view that Powell will not be fired, and senior administration officials say Trump recognizes he doesn’t have that authority. But even continued exploration of the possibility could make for a volatile week.

The market response to a material threat to the Fed’s independence would be complicated, according to Steve Englander, head of global G-10 FX research and North America macro strategy for Standard Chartered Bank. He said near-term uncertainty over the process and politics in a fluid situation would weigh on equity prices and bond yields. The dollar, he said, would likely face multiple opposing forces, but the “near-term response is likely negative on the risk that U.S. economic policy becomes more erratic.”

Kitchen Sink

The Bloomberg Dollar Index was up more than 4 percent in 2018 at the end of last week and is close to its highest level in a year and a half, while the Japanese yen surged around 2 percent last week versus the greenback.

Chris Rupkey, chief financial economist at MUFG Union Bank in New York, is among the few eyeing the strained relations between the president and the Fed chair with equanimity.

The stock market “has discounted everything but the kitchen sink, including the loss of a Fed Chair who hasn’t been in office for even a year yet,” he said by email.

Given that the Fed is already close to the end of its hiking cycle, the markets won’t melt down if Powell leaves office, according to Rupkey. “They already did,” he said.

Those on the front lines of this week’s opening trade say markets are on a knife edge.

Mind the Machines

“If equity markets fall further, they’re going to set off machine-based selling,” said Saed Abukarsh, the co-founder of Dubai-based hedge fund Ark Capital Management. “The other risk is that experienced traders are on holiday, so the ones left will be trigger happy with every new headline.”

“I can’t see buyers stepping into this market to stem off any selling pressure until January,” said Abukarsh. “So if you need to adjust your books for the year-end with any meaningful size, you’re going to have to pay for it.”

Trump’s two-year stock honeymoon ends with hunt for betrayer

Nobody was happier to take credit for surging stocks than Donald Trump, who touted and tweeted each leg up. Now the bull is on life support and the search for its killer is on.

And while many on Wall Street share the president’s frustration with the man atop his markets enemies list, Federal Reserve Chairman Jerome Powell, they say Trump himself risks making things worse with too much aggression when equities are one bad session away from a bear market.

“You would think that after coming off of the worst week for the markets since the financial crisis in 2008, he would look to create some stability,” said Chuck Cumello, CEO of Essex Financial Services. “Instead we get the opposite, with this headline and more self-induced uncertainty. This coming from a president who when the market goes up views it as a barometer of his success.”

U.S. stock futures whipsawed Monday and were little changed after swinging from a 0.9 percent gain to a loss of the same magnitude. The equity market closes at 1 p.m. in New York ahead of the Christmas holiday.

Click here to see all of Trump’s tweets on the economy and markets.

Attempts by Treasury Secretary Steven Mnuchin to reassure markets that Powell wouldn’t be ousted appeared to have largely removed that as an immediate concern for traders, but the secretary’s tweet Sunday that he called top executives from the six largest U.S. banks to check on their liquidity and lending infrastructure added to anxiety.

To be sure, equities remain solidly higher since Trump took office. Even with its 17 percent drop over the last three months, the S&P 500 has risen 18 percent since Election Day. The Nasdaq Composite Index is up 25 percent with dividends. True, volatility has jumped to a 10-month high, but market turbulence was significantly worse for three long stretches under Barack Obama.

The S&P 500 slumped 7.1 percent last week and the Nasdaq Composite Index spiraled into a bear market. As of 2:31 p.m. in Hong Kong, futures on the S&P 500 were up 0.6 percent while Nasdaq 100 contracts added 0.5 percent.

While Trump seems to have found his villain in Powell, blame is a dubious concept in financial markets, as anyone who has tried to explain the current rout can attest.

Along with the Fed chairman, everything from rising bond yields, trade tariffs, falling bond yields, Brexit, tech valuations and Italian finances have been implicated in the downdraft that has erased $5 trillion from American equity values in three months.

Whatever’s behind it, nothing has been able to stop it. And while many on Wall Street credit the president for helping jump-start the market after taking office, they say he should look in the mirror to see another person creating stress for it right now.

“Trump was gloating how much good he had done for the economy and the market. Now he’s blaming Powell for the decline instead of himself,” said Rick Bensignor, founder of Bensignor Group and a former strategist for Morgan Stanley. “Half his key staff has been fired or quit. The markets are off for a variety of reasons, but most of them have Trump behind them.”

If Trump is bent on getting rid of Powell, there may be ways of doing it that don’t risk kicking a volatile market into hysteria, said Walter “Bucky” Hellwig, a senior vice president at BB&T Wealth Management in Birmingham, Alabama.

“It doesn’t have to be firing, it could be someone else taking Powell’s job. That could be a net positive for the markets,” Hellwig said. “A friendly change in the head of the Fed may cause some turbulence short-term but it may be offset with the markets repricing the risk associated with two rate hikes in 2019.”

For now, the turmoil shows no signs of letting up. In the Nasdaq 100, home to tech giants like Apple Inc. and Amazon.com, there have been 17 sessions with losses greater than 1.5 percent this quarter, the most since 2009. Small caps are down 26 percent from a record, while the Nasdaq Biotech Index has dropped at least 1 percent on seven straight days, the longest streak since its inception in 1993.

It’s been a long time since anyone in the U.S. has lived through this protracted a decline. Including Trump.

”It’s impossible to tease out what the proximate causes are,” said Kevin Caron, a senior portfolio manager at Washington Crossing Advisors. “The normal ebb and flow of financial markets are all part of the mix. It’s impossible just to point to the chairman as the only input.”

Credit: Bloomberg

Related:

Panic In Washington – Treasury Secretary Calls Top Bankers To Check Liquidity, While On Vacation

Stock Market Crash Could Force "Tariff Man" Trump To Surrender Trade War To China

https://youtu.be/mSuuYbO3C-U

Related posts:

Photo: VCG China’s business people, researchers, scholars say they ‘feel the chill’ in US Growing China-US tensions have affected te...

https://youtu.be/hASoHG1gDcs

https://youtu.be/bbtVTlZW_g0 https://youtu.be/PCpch4DOIdE

https://youtu.be/mSuuYbO3C-U https://y...

Samsung’s foldable device with Infinity Flex Display is a smartphone model that features a tablet-sized screen when unfolded and a smaller screen when folded like a book. — AP

Samsung’s foldable device with Infinity Flex Display is a smartphone model that features a tablet-sized screen when unfolded and a smaller screen when folded like a book. — AP  Vodafone demonstrated how a young football fan could get Houghton (left) to teach her some football skills with a holographic 3D call on a 5G network. — AP

Vodafone demonstrated how a young football fan could get Houghton (left) to teach her some football skills with a holographic 3D call on a 5G network. — AP Companies like Sony, Microsoft and Nintendo could all be announcing new gaming consoles in 2019. — AP

Companies like Sony, Microsoft and Nintendo could all be announcing new gaming consoles in 2019. — AP AR is likely to become a bigger part of the way we experience events in real life and consume content on social media platforms. Here, an attendee is trying out an AR baseball game at a trade show in Japan. — Bloomberg

AR is likely to become a bigger part of the way we experience events in real life and consume content on social media platforms. Here, an attendee is trying out an AR baseball game at a trade show in Japan. — Bloomberg Get set to support a Malaysian eSports team at the 2019 SEA Games. — Bernama

Get set to support a Malaysian eSports team at the 2019 SEA Games. — Bernama