While young adults all over the world are renting homes, Malaysias prefer to own homes as soon as they get their first pay cheque.

Instead of blowing their cash on pricey gadgets, young Malaysians are saving up for their first home.

While most Gen Y shy away from owning property in developed countries and big cities, demand from millennials here is still holding, especially with parents assisting them with the downpayment, Real Estate and Housing Developers’ Association Malaysia (Rehda) president Datuk Seri F.D. Iskandar said.

(Gen Y, also known as millennials, are commonly referred to those who are born in the early 1980s to 2000s. They are sometimes referred to as the strawberry generation).

Demand from first-time buyers, including the younger generation, remains strong although housing affordability is a challenge, said Bank Negara.

The central bank added that they accounted for 75% of 1.47 million borrowers.

Owning and investing in a house remains a priority for many Malaysians.

This is reflected in the household borrowing trend where the buying of homes continues to be the fastest growing segment of household lending, with annual growth sustained at double-digit levels (11% as at end-March 2016), said Bank Negara in a statement.

Those who cannot afford it themselves, and do not have parents to help, turn to their friends.

In his 30s, Daryl Toh, and two of his college mates own a condominium in Penang; they pooled their resources to purchase the unit five years ago.

“It’s in a premium area and since we couldn’t afford a place on our own – at least not prime property, we became joint owners.”

Financial adviser Yap Ming Hui said it makes perfect sense to own.

“Of course the Gen Y here are still keen on buying. You pay the instalments and eventually own a home. Only those who can’t afford to buy are forced to rent.”

Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector of Malaysia adviser Wong Kok Soo said property prices in Hong Kong have escalated beyond the purchasing power of the Gen Y but the trend hasn’t caught on here – yet.

Wong, who is also a consultant with the National House Buyers Association, however, said there were signs that the Gen Y could no longer afford to live in big cities like Kuala Lumpur, Penang Island, Johor Baru and Sabah.

“Parents are chipping in for the downpayment. And, commuting from the suburbs to the city centre is still an option.

“But when prices get inflated far beyond their means, the same will happen here (as in Hong Kong),” said Wong, who, however, felt that even if demand dropped, it would not be substantial.

Iskandar agreed, saying that although the property market was slow now, the drop was manageable. “Like everything else, it’s cyclical. “The property market goes up for years and after some time, begins falling before rising again.”

He said the market would pick up with the completion of infrastructure development and public transportation facilities.

Rehda, he said, was working closely with the Government to find ways to facilitate home acquisition especially among first-time buyers.

“We proposed a review of the financing guidelines that have negatively impacted buyers’ ability to secure financing,” he said. - The Star/Asia News Network

PETALING JAYA: Instead of blowing their cash on pricey gadgets, young Malaysians are saving up for their first home.

While most Gen Y shy away from owning property in developed countries and big cities, demand from millennials here is still holding, especially with parents assisting them with the downpayment, Real Estate and Housing Developers’ Association Malaysia (Rehda) president Datuk Seri F.D. Iskandar said.

(Gen Y, also known as millennials, are commonly referred to those who are born in the early 1980s to 2000s. They are sometimes referred to as the strawberry generation).

Demand from first-time buyers, including the younger generation, remains strong although housing affordability is a challenge, said Bank Negara.

The central bank added that they accounted for 75% of 1.47 million borrowers.

Owning and investing in a house remains a priority for many Malaysians.

This is reflected in the household borrowing trend where the buying of homes continues to be the fastest growing segment of household lending, with annual growth sustained at double-digit levels (11% as at end-March 2016), said Bank Negara in a statement.

Those who cannot afford it themselves, and do not have parents to help, turn to their friends.

In his 30s, Daryl Toh, and two of his college mates own a condominium in Penang; they pooled their resources to purchase the unit five years ago.

“It’s in a premium area and since we couldn’t afford a place on our own – at least not prime property, we became joint owners.”

Financial adviser Yap Ming Hui said it makes perfect sense to own.

“Of course the Gen Y here are still keen on buying. You pay the instalments and eventually own a home. Only those who can’t afford to buy are forced to rent.”

Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector of Malaysia adviser Wong Kok Soo said property prices in Hong Kong have escalated beyond the purchasing power of the Gen Y but the trend hasn’t caught on here – yet.

Wong, who is also a consultant with the National House Buyers Association, however, said there were signs that the Gen Y could no longer afford to live in big cities like Kuala Lumpur, Penang Island, Johor Baru and Sabah.

“Parents are chipping in for the downpayment. And, commuting from the suburbs to the city centre is still an option.

“But when prices get inflated far beyond their means, the same will happen here (as in Hong Kong),” said Wong, who, however, felt that even if demand dropped, it would not be substantial.

Iskandar agreed, saying that although the property market was slow now, the drop was manageable.

“Like everything else, it’s cyclical.

“The property market goes up for years and after some time, begins falling before rising again.”

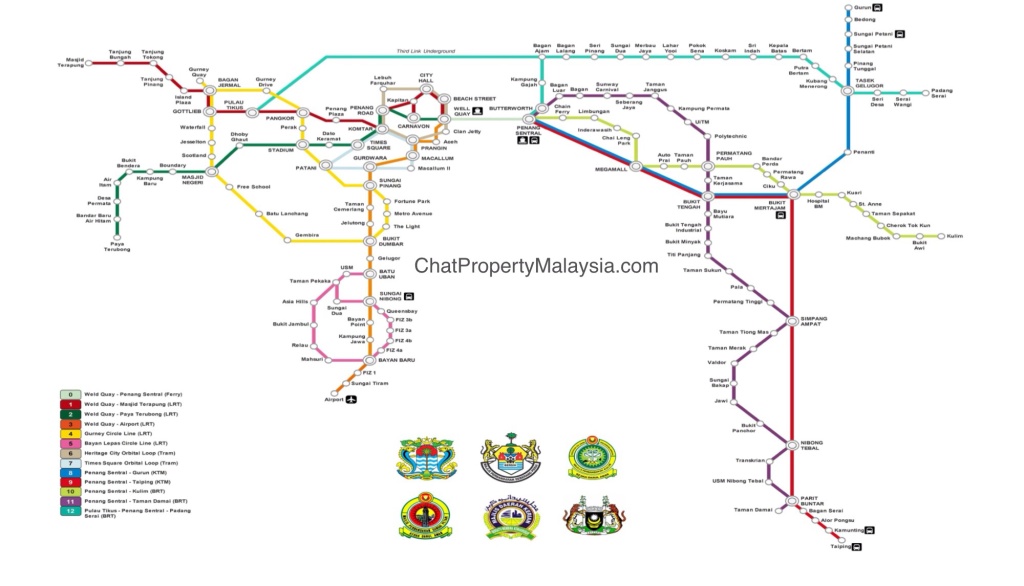

He said the market would pick up with the completion of infrastructure development and public transportation facilities.

Rehda, he said, was working closely with the Government to find ways to facilitate home acquisition especially among first-time buyers.

“We proposed a review of the financing guidelines that have negatively impacted buyers’ ability to secure financing,” he said. - By Christina Chin The Star

Wary of big, life-changing purchases, the ‘Strawberry Generation’ – those ‘easily bruised’, coddled young people in their 30s – prefers to rent, global reports say. Malaysians, however, are bucking the trend despite steep property prices. Mainly thanks to supportive parents, it seems.

BEST friends Leh Mon Soo, 38, and Brandy Yu, 39, are finally buying their first home.

After months of serious scouting, the two managers found units that matched their budget and needs, coincidentally, in the same condominium in Petaling Jaya. Leh is getting a three-bedroom unit while Yu is happy with a 48sqm studio apartment.

Yu feels that the RM365,000 she’s paying is affordable as she can still save about RM1,700 monthly after paying the loan instalment.

“I’m only paying RM400 more a month than what I’ve been forking out for rent. And unlike the rental, this unit will be mine one day,” she says.

Leh ended up forking out a whopping RM690,000 even though she dreads the long-term commitment. While “not a bargain, and at the upper limit of what I can afford”, she says that it’s still a pretty good price, as other, smaller, units were going for higher prices.

“I was only willing to pay RM500,000 initially. Then I saw a two-bedroom in the same condominium going for RM680,000. So I bit the bullet and got this. Property prices won’t be dropping any time soon and our ringgit’s shrinking. It’s now or never. I’ll have to cough up even more later if I don’t get a place now,” she says pragmatically.

The soon-to-be neighbours think property is still in demand, even among Gen Y-ers, aka Millennials (those born in the 1980s and 1990s, typically perceived as brought up and very familiar with digital and electronic technology).

But they’re more privileged because their parents have either already invested in property for them or are helping them buy it, Leh offers. Renting is not for the long-term, she says firmly, and even the younger ones know that.

The Malaysian mindset, Yu quips, is that everyone must own at least one property.

Gym owner Chip Ang, 26, agrees. He got the keys to his new 78sqm unit in Shah Alam last week.

Although it was his parents who suggested he get the RM168,000 place under the Selangor Government’s affordable housing scheme, Ang says property ownership is always a hot topic between him and his friends. Young professionals want to own property. The issue is affordability, he thinks.

“Many are unrealistic. They want their ideal home in the ideal place. Of course that’s unaffordable. Most affordable homes are in up and coming townships, not prime locations.”

The experience of getting his own place was a “blur” because it happened so fast, he says, though he does recall that, “because it’s affordable housing, I had to fulfil a number of requirements including proving that I’m a bachelor”. While the RM700 monthly mortgage payment is doable, he’s still nervous about being “tied down”.

Writer Teddy Gomez, 29, doesn’t think people have given up on owning property but sees a new trend emerging.

“Buying property is still big here but I see more renters because it’s cheaper and more flexible,” says Gomez, who got “a little help” from his dad buying a 83sqm apartment in Kuala Lumpur last year. Although the cosy RM400,000 unit is “not really affordable”, he says it’s time to leave the nest.

Like Gomez, a blogger who only wants to be known as Robyn, 24, thinks it’s nice to have your own space. She’s moving into an apartment in Petaling Jaya soon. The fresh graduate admits being lucky because her dad’s the owner. She’s getting the three-room unit for less than RM140,000 although it’s valued at over RM750,000.

“For the next three years, I’ll pay the RM3,800 monthly loan instalments. Now, I’m only contributing RM2,000 because I just started working. Dad’s helping until I can afford to take on the full amount myself.”

She knows she’s better off than most her age and is thankful for her family’s support – many of her friends are also looking for properties to buy but are resigned to living outside the city in places like Bangi and Kajang in Selangor. Still, with a RM200,000 budget, they’re willing to travel and own property rather than pay rent indefinitely.

Federation of Malaysian Consumers Association (Fomca) secretary-general Datuk Paul Selvaraj says it’s unfair to tell consumers to live on the outskirts of city centres because public transportation is still a problem in the Klang Valley. Unless the homes are accessible, living far away from the workplace isn’t practical.

National House Buyers Association (HBA) honorary secretary-general Chang Kim Loong sees a very strong demand for affordable properties in Malaysia because of our young population and urban migration.

For instance, the Government’s First House Deposit Financing (MyDeposit) scheme that was launched on April 6 received more than 6,000 online registrations within a week, a sure sign that Malaysians are still keen on owning property.

Fomca’s Selvaraj says property is a priority for most Malaysians because it’s a sound investment. They just can’t afford it in most urban areas.

“If you’re living on bread and water after paying your loan, then the house is unaffordable. For most young families, RM300,000-plus is affordable but it’s RM600,000 homes that are being built.”

Property is the best hedge against inflation so demand will always be strong, says HBA’s Chang. But there’s a “serious mismatch” between what’s classified as affordable by developers and the rakyat’s definition. To developers, an affordable property for first-time buyers is RM500,000. For upgraders, it’s up to RM1mil. Definitions on the ground are much lower. First-time buyers deem RM150,000 to RM300,000 affordable while those looking to upgrade can only pay between RM300,000 and RM600,000.

But if you can afford it – with family help, perhaps – M. Rajendran, 53, says invest early. The air traffic controller got his double-storey home in Kajang 21, Selangor, years ago for RM146,000. It’s worth at least RM600,000 now.

“If I hadn’t bought it then, I definitely wouldn’t be able to afford it now with the financial commitments I have. And at my age, no bank is going to give me a loan. Buy when you’re young because it’s cheaper and you can settle your loan faster.”

However, he warns that current economic challenges could result in a rise in the number of abandoned projects, so those looking at new properties should be cautious and do their homework.

“Scout around. Choose locations with infrastructure and amenities so that the potential for property prices to appreciate is higher.” - By Christina Chin The Star

RELAXING lending conditions won’t help more people buy their own homes. It will only worsen the situation as developers increase prices further to match the lending surge, predicts Chang Kim Loong, honorary secretary-general of the National House Buyers Association (HBA).

Datuk Paul Selvaraj also doesn’t think it’s a good idea. The Federation of Malaysian Consumers Association secretary-general says home ownership is a right, and it’s the Government’s responsibility to make it a reality. The Government, he stresses, must either build more affordable housing or force developers to cater to the neglected market. It’s wrong to force banks to take bigger lending risks by calling on them to relax lending conditions, he feels.

“Banks will only lend money if they can get it back. It’s unfair to expect them to do otherwise. Also, if the borrowers cannot pay, they themselves will end up with a big headache.”

Banks are rightly stringent as times are uncertain, says Wong Kok Soo, an adviser to the Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector of Malaysia and consultant to the HBA.

Lenient policies encourage purchases that are beyond one’s means and are not a good idea; instead, the margin of financing should be increased or the loan tenure extended, for first home buyers. For existing loans, there should be some flexibility in extending tenures and adjusting debt servicing ratio, he feels.

Last year, housing in Kelantan, Penang, Sabah, Sarawak and Selangor, as well as Kuala Lumpur, were listed as severely unaffordable by market experts. Nationwide, only Malacca made the affordable category with housing in the other states deemed either seriously or moderately unaffordable.

Bank Negara’s “Financial Stability and Payment Systems Report 2015” showed an increasing supply of homes above RM500,000 while those priced below RM250,000 accounted for less than 30% of the total launches in the first nine months of last year.

Deputy Urban Wellbeing, Housing and Local Government Minister Datuk Halimah Mohamed Sadique has since called on developers to build more houses priced at RM300,000 for Malaysians.

The next generation won’t be able to own property without financial help from their parents unless concrete measures are taken to increase the supply of properties costing between RM150,000 and RM300,000 and to stem the steep rise in existing property prices due to excessive speculation, says HBA’s Chang.

A Khazanah Research Institute report reveals that Malaysia’s housing market is considered to be “seriously unaffordable”, with a median house price of more than four times the median annual household income. This problem, Chang notes, surfaced a little under a decade ago but if prices continue to soar, the situation could worsen.

Not that there aren’t affordable schemes and funding plans in place to help – in the last 50 years, scores have been introduced but information on them is scarce, he observes. Details of projects by developers, state agencies and federal bodies must be available in a public database, he suggests. And a single umbrella body under the Federal Government must coordinate the distribution and availability of such units.

Chang stresses also that there’s no place for racial profiling when it comes to housing. Whoever deserves a house must get a house, he insists.

There’s never a wrong time to buy property but one must balance the risk of buying with renting, he advices. Owning a house is riskier as buyers take on enormous debts, sign multi-year loan agreements and become responsible for homeowner costs, he cautions.

“Flip through the newspapers – you’ll see many proclamations of sales of units for public auction that are below RM50,000. Some even dip below RM10,000. On bank websites, you’ll find property foreclosure cases.”

A list of properties put up for auction by CIMB bank showed 35 units in Selangor at reserved prices of less than RM42,000 – that’s the price of a new low-cost unit, notes Chang.

Low-cost units auctioned off for half of the purchase price is an alarming trend, he says. Unfortunately, there aren’t any official statistics on how many low income earners have lost their homes or are struggling with their monthly loan commitment. Where do these homeowners and their families end up living, Chang wonders.

Foreclosures can devastate a family’s economic and social standing, possibly leaving them poorer than before they bought the property. Financiers, local authorities and communities benefit from homeowners being better informed of their rights and responsibilities as borrowers. Ensuring that lower income households have sufficient personal financial management skills and support is crucial.

It’s not enough just to provide homes for the low- and medium-income group. Chang recommends that a homeownership education programme be set up to raise financial literacy and prepare households for the responsibilities of owning a home.

“Manuals, advice or information given via telephone, workshops or counselling to help households maintain their homes and manage their finances must be given before first-time buyers sign the sale and purchase agreement. Public housing schemes are only successful if buyers can hold on to their property.”

Specifically, Chang says education should cover:

> Pre-purchase period – understanding the various types of available housing, the process of buying a house, loan process, and financial preparation needed; and evaluating household needs.

> Post-purchase period – budgeting monthly expenses; making payments promptly; avoiding loan defaults; living within a community; social responsibility; property taxes, assessments, insurance, service charges and sinking fund; home maintenance; and handling problems with the property.

Educate yourself and learn from the mistakes of others to avoid being disappointed or, worse, becoming “house poor” (when most of your income goes towards home ownership), Chang advises. Aspiring buyers must get something that’s within their budget. It could be an older or smaller unit but start small and slowly increase your property portfolio, he says.

“Don’t let friends or family influence you into getting something that’s above your budget, as home ownership is a long term investment. You must be able to service the loan while maintaining an acceptable standard of living.”

The majority may prefer to rent while waiting for the market to soften but it’s better to have your own shelter, says HBA consultant Wong.

The average Malaysian, he insists, can still own property. Consider buying at auctions. Research is a must, though, as inspections aren’t allowed at auctions. It’s an “as is, where is” bid, he stresses. Find out about the surrounding units and the neighbourhood, he suggests.

PROPERTY investment helps maintain our socioeconomic well-being and must be encouraged, says Datuk Seri F.D. Iskandar, president of the Real Estate and Housing Developers Association Malaysia (Rehda).

Property – a wealth-creation instrument without the volatility of stock markets – has consistently out-performed traditional investment options like bonds, he points out.

But to invest, one must study the property and its market potential. With the right location and strategy, property can be a very profitable investment. The value will appreciate over time, he says.

To many, the most important aspect of owning property is to secure a home. In current conditions, most developers are coming up with attractive packages to close the deal, so it’s a good time to buy. Securing a bank loan now, though, is one of the biggest barriers, he says.

Rehda’s recommendations to the Government and Bank Negara are:

> Encourage innovative home financing packages like the developers interest bearing scheme (better known as DIBS).

> Allow flexible or accelerated tiered payments (longer loan tenure so you pay less now but more later when your salary has increased).

> Relax loan approval criteria with higher financing margins (up to 100%).

Also, banks, he says, shouldn’t just focus on a loan applicant’s current net income; future prospects of higher salaries and other incomes and bonuses must be taken into account.

He dismisses talk that the average Malaysian has been priced out of owning his or her first home.

There’s still a range of prices and options in both the primary and secondary property markets, he says.

With new launches, developers usually offer special incentives, rebates or discounts that will help buyers reduce their initial payment. In the secondary market, however, what you see is what you get. Depending on what you’re looking for, factors like location, surroundings, facilities, transportation and infrastructure will help you decide.

“Property prices in city centres are high because of land value but there are many cheaper options in less-urbanised areas. There are many affordable houses, including those by PR1MA (the 1Malaysia People’s Housing Scheme). The average Malaysian can definitely afford these.

“With an improving transportation system and connectivity, these places are now easily accessible from city centres.”

WAGES are rising in tandem with the country’s consumer price index (CPI), which is a broad measure of inflation and our productivity.

Both criteria are used to determine wages here, says Datuk Shamsuddin Bardan, executive director of the Malaysian Employers Federation.

While Malaysians lament how their salaries aren’t enough to cope with soaring costs of products and services, their grouses aren’t reflected in the low CPI numbers, he says.

“Measured against the CPI, our average salary growth isn’t lagging. In the region, our salaries are second only to Singapore. Of course, you must consider the currency exchange. Singaporeans earn an average of S$3,000 (RM9,000) while Malaysians take home RM2,800 monthly.

“But bear in mind that the productivity of Singaporeans is 3.8 times higher than ours. Their per unit cost of production per employee is lower than us. In the United States, the productivity level is seven times higher than ours. So when you say we aren’t earning enough, you have to consider our productivity level too,” he states, pointing to how in some of our neighbouring countries, the average salary is less than US$100 (RM400).

However, he acknowledges that houses are beyond the reach of most – and fresh graduates in particular – and adds that even when both husband and wife work, they still may not have enough for the down payment and are forced to rent.

It’s tough, he admits, even for those who have already been working for a decade, to own a house now without financial support from parents.

Related: Renting is OK too

Related Posts:

3 days ago ... THE Penang housing market moved sideways on both the primary and .....

Penang's lively market ·

Instead of blowing their cash on pricey gadgets, young Malaysians are saving up for their first home.

While most Gen Y shy away from owning property in developed countries and big cities, demand from millennials here is still holding, especially with parents assisting them with the downpayment, Real Estate and Housing Developers’ Association Malaysia (Rehda) president Datuk Seri F.D. Iskandar said.

(Gen Y, also known as millennials, are commonly referred to those who are born in the early 1980s to 2000s. They are sometimes referred to as the strawberry generation).

Demand from first-time buyers, including the younger generation, remains strong although housing affordability is a challenge, said Bank Negara.

The central bank added that they accounted for 75% of 1.47 million borrowers.

Owning and investing in a house remains a priority for many Malaysians.

This is reflected in the household borrowing trend where the buying of homes continues to be the fastest growing segment of household lending, with annual growth sustained at double-digit levels (11% as at end-March 2016), said Bank Negara in a statement.

Those who cannot afford it themselves, and do not have parents to help, turn to their friends.

In his 30s, Daryl Toh, and two of his college mates own a condominium in Penang; they pooled their resources to purchase the unit five years ago.

“It’s in a premium area and since we couldn’t afford a place on our own – at least not prime property, we became joint owners.”

Financial adviser Yap Ming Hui said it makes perfect sense to own.

“Of course the Gen Y here are still keen on buying. You pay the instalments and eventually own a home. Only those who can’t afford to buy are forced to rent.”

Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector of Malaysia adviser Wong Kok Soo said property prices in Hong Kong have escalated beyond the purchasing power of the Gen Y but the trend hasn’t caught on here – yet.

Wong, who is also a consultant with the National House Buyers Association, however, said there were signs that the Gen Y could no longer afford to live in big cities like Kuala Lumpur, Penang Island, Johor Baru and Sabah.

“Parents are chipping in for the downpayment. And, commuting from the suburbs to the city centre is still an option.

“But when prices get inflated far beyond their means, the same will happen here (as in Hong Kong),” said Wong, who, however, felt that even if demand dropped, it would not be substantial.

Iskandar agreed, saying that although the property market was slow now, the drop was manageable. “Like everything else, it’s cyclical. “The property market goes up for years and after some time, begins falling before rising again.”

He said the market would pick up with the completion of infrastructure development and public transportation facilities.

Rehda, he said, was working closely with the Government to find ways to facilitate home acquisition especially among first-time buyers.

“We proposed a review of the financing guidelines that have negatively impacted buyers’ ability to secure financing,” he said. - The Star/Asia News Network

Demand from first-time buyers still strong despite affordability challenge

PETALING JAYA: Instead of blowing their cash on pricey gadgets, young Malaysians are saving up for their first home.

While most Gen Y shy away from owning property in developed countries and big cities, demand from millennials here is still holding, especially with parents assisting them with the downpayment, Real Estate and Housing Developers’ Association Malaysia (Rehda) president Datuk Seri F.D. Iskandar said.

(Gen Y, also known as millennials, are commonly referred to those who are born in the early 1980s to 2000s. They are sometimes referred to as the strawberry generation).

Demand from first-time buyers, including the younger generation, remains strong although housing affordability is a challenge, said Bank Negara.

The central bank added that they accounted for 75% of 1.47 million borrowers.

Owning and investing in a house remains a priority for many Malaysians.

This is reflected in the household borrowing trend where the buying of homes continues to be the fastest growing segment of household lending, with annual growth sustained at double-digit levels (11% as at end-March 2016), said Bank Negara in a statement.

Those who cannot afford it themselves, and do not have parents to help, turn to their friends.

In his 30s, Daryl Toh, and two of his college mates own a condominium in Penang; they pooled their resources to purchase the unit five years ago.

“It’s in a premium area and since we couldn’t afford a place on our own – at least not prime property, we became joint owners.”

Financial adviser Yap Ming Hui said it makes perfect sense to own.

“Of course the Gen Y here are still keen on buying. You pay the instalments and eventually own a home. Only those who can’t afford to buy are forced to rent.”

Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector of Malaysia adviser Wong Kok Soo said property prices in Hong Kong have escalated beyond the purchasing power of the Gen Y but the trend hasn’t caught on here – yet.

Wong, who is also a consultant with the National House Buyers Association, however, said there were signs that the Gen Y could no longer afford to live in big cities like Kuala Lumpur, Penang Island, Johor Baru and Sabah.

“Parents are chipping in for the downpayment. And, commuting from the suburbs to the city centre is still an option.

“But when prices get inflated far beyond their means, the same will happen here (as in Hong Kong),” said Wong, who, however, felt that even if demand dropped, it would not be substantial.

Iskandar agreed, saying that although the property market was slow now, the drop was manageable.

“Like everything else, it’s cyclical.

“The property market goes up for years and after some time, begins falling before rising again.”

He said the market would pick up with the completion of infrastructure development and public transportation facilities.

Rehda, he said, was working closely with the Government to find ways to facilitate home acquisition especially among first-time buyers.

“We proposed a review of the financing guidelines that have negatively impacted buyers’ ability to secure financing,” he said. - By Christina Chin The Star

A pricey priority

Wary of big, life-changing purchases, the ‘Strawberry Generation’ – those ‘easily bruised’, coddled young people in their 30s – prefers to rent, global reports say. Malaysians, however, are bucking the trend despite steep property prices. Mainly thanks to supportive parents, it seems.

BEST friends Leh Mon Soo, 38, and Brandy Yu, 39, are finally buying their first home.

After months of serious scouting, the two managers found units that matched their budget and needs, coincidentally, in the same condominium in Petaling Jaya. Leh is getting a three-bedroom unit while Yu is happy with a 48sqm studio apartment.

Yu feels that the RM365,000 she’s paying is affordable as she can still save about RM1,700 monthly after paying the loan instalment.

“I’m only paying RM400 more a month than what I’ve been forking out for rent. And unlike the rental, this unit will be mine one day,” she says.

Leh ended up forking out a whopping RM690,000 even though she dreads the long-term commitment. While “not a bargain, and at the upper limit of what I can afford”, she says that it’s still a pretty good price, as other, smaller, units were going for higher prices.

“I was only willing to pay RM500,000 initially. Then I saw a two-bedroom in the same condominium going for RM680,000. So I bit the bullet and got this. Property prices won’t be dropping any time soon and our ringgit’s shrinking. It’s now or never. I’ll have to cough up even more later if I don’t get a place now,” she says pragmatically.

The soon-to-be neighbours think property is still in demand, even among Gen Y-ers, aka Millennials (those born in the 1980s and 1990s, typically perceived as brought up and very familiar with digital and electronic technology).

But they’re more privileged because their parents have either already invested in property for them or are helping them buy it, Leh offers. Renting is not for the long-term, she says firmly, and even the younger ones know that.

The Malaysian mindset, Yu quips, is that everyone must own at least one property.

Gym owner Chip Ang, 26, agrees. He got the keys to his new 78sqm unit in Shah Alam last week.

Although it was his parents who suggested he get the RM168,000 place under the Selangor Government’s affordable housing scheme, Ang says property ownership is always a hot topic between him and his friends. Young professionals want to own property. The issue is affordability, he thinks.

“Many are unrealistic. They want their ideal home in the ideal place. Of course that’s unaffordable. Most affordable homes are in up and coming townships, not prime locations.”

The experience of getting his own place was a “blur” because it happened so fast, he says, though he does recall that, “because it’s affordable housing, I had to fulfil a number of requirements including proving that I’m a bachelor”. While the RM700 monthly mortgage payment is doable, he’s still nervous about being “tied down”.

Writer Teddy Gomez, 29, doesn’t think people have given up on owning property but sees a new trend emerging.

“Buying property is still big here but I see more renters because it’s cheaper and more flexible,” says Gomez, who got “a little help” from his dad buying a 83sqm apartment in Kuala Lumpur last year. Although the cosy RM400,000 unit is “not really affordable”, he says it’s time to leave the nest.

Like Gomez, a blogger who only wants to be known as Robyn, 24, thinks it’s nice to have your own space. She’s moving into an apartment in Petaling Jaya soon. The fresh graduate admits being lucky because her dad’s the owner. She’s getting the three-room unit for less than RM140,000 although it’s valued at over RM750,000.

“For the next three years, I’ll pay the RM3,800 monthly loan instalments. Now, I’m only contributing RM2,000 because I just started working. Dad’s helping until I can afford to take on the full amount myself.”

She knows she’s better off than most her age and is thankful for her family’s support – many of her friends are also looking for properties to buy but are resigned to living outside the city in places like Bangi and Kajang in Selangor. Still, with a RM200,000 budget, they’re willing to travel and own property rather than pay rent indefinitely.

Federation of Malaysian Consumers Association (Fomca) secretary-general Datuk Paul Selvaraj says it’s unfair to tell consumers to live on the outskirts of city centres because public transportation is still a problem in the Klang Valley. Unless the homes are accessible, living far away from the workplace isn’t practical.

National House Buyers Association (HBA) honorary secretary-general Chang Kim Loong sees a very strong demand for affordable properties in Malaysia because of our young population and urban migration.

For instance, the Government’s First House Deposit Financing (MyDeposit) scheme that was launched on April 6 received more than 6,000 online registrations within a week, a sure sign that Malaysians are still keen on owning property.

Fomca’s Selvaraj says property is a priority for most Malaysians because it’s a sound investment. They just can’t afford it in most urban areas.

“If you’re living on bread and water after paying your loan, then the house is unaffordable. For most young families, RM300,000-plus is affordable but it’s RM600,000 homes that are being built.”

Property is the best hedge against inflation so demand will always be strong, says HBA’s Chang. But there’s a “serious mismatch” between what’s classified as affordable by developers and the rakyat’s definition. To developers, an affordable property for first-time buyers is RM500,000. For upgraders, it’s up to RM1mil. Definitions on the ground are much lower. First-time buyers deem RM150,000 to RM300,000 affordable while those looking to upgrade can only pay between RM300,000 and RM600,000.

But if you can afford it – with family help, perhaps – M. Rajendran, 53, says invest early. The air traffic controller got his double-storey home in Kajang 21, Selangor, years ago for RM146,000. It’s worth at least RM600,000 now.

“If I hadn’t bought it then, I definitely wouldn’t be able to afford it now with the financial commitments I have. And at my age, no bank is going to give me a loan. Buy when you’re young because it’s cheaper and you can settle your loan faster.”

However, he warns that current economic challenges could result in a rise in the number of abandoned projects, so those looking at new properties should be cautious and do their homework.

“Scout around. Choose locations with infrastructure and amenities so that the potential for property prices to appreciate is higher.” - By Christina Chin The Star

Don’t bank on the banks

RELAXING lending conditions won’t help more people buy their own homes. It will only worsen the situation as developers increase prices further to match the lending surge, predicts Chang Kim Loong, honorary secretary-general of the National House Buyers Association (HBA).

Datuk Paul Selvaraj also doesn’t think it’s a good idea. The Federation of Malaysian Consumers Association secretary-general says home ownership is a right, and it’s the Government’s responsibility to make it a reality. The Government, he stresses, must either build more affordable housing or force developers to cater to the neglected market. It’s wrong to force banks to take bigger lending risks by calling on them to relax lending conditions, he feels.

“Banks will only lend money if they can get it back. It’s unfair to expect them to do otherwise. Also, if the borrowers cannot pay, they themselves will end up with a big headache.”

Banks are rightly stringent as times are uncertain, says Wong Kok Soo, an adviser to the Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector of Malaysia and consultant to the HBA.

Lenient policies encourage purchases that are beyond one’s means and are not a good idea; instead, the margin of financing should be increased or the loan tenure extended, for first home buyers. For existing loans, there should be some flexibility in extending tenures and adjusting debt servicing ratio, he feels.

Last year, housing in Kelantan, Penang, Sabah, Sarawak and Selangor, as well as Kuala Lumpur, were listed as severely unaffordable by market experts. Nationwide, only Malacca made the affordable category with housing in the other states deemed either seriously or moderately unaffordable.

Bank Negara’s “Financial Stability and Payment Systems Report 2015” showed an increasing supply of homes above RM500,000 while those priced below RM250,000 accounted for less than 30% of the total launches in the first nine months of last year.

Deputy Urban Wellbeing, Housing and Local Government Minister Datuk Halimah Mohamed Sadique has since called on developers to build more houses priced at RM300,000 for Malaysians.

The next generation won’t be able to own property without financial help from their parents unless concrete measures are taken to increase the supply of properties costing between RM150,000 and RM300,000 and to stem the steep rise in existing property prices due to excessive speculation, says HBA’s Chang.

A Khazanah Research Institute report reveals that Malaysia’s housing market is considered to be “seriously unaffordable”, with a median house price of more than four times the median annual household income. This problem, Chang notes, surfaced a little under a decade ago but if prices continue to soar, the situation could worsen.

Not that there aren’t affordable schemes and funding plans in place to help – in the last 50 years, scores have been introduced but information on them is scarce, he observes. Details of projects by developers, state agencies and federal bodies must be available in a public database, he suggests. And a single umbrella body under the Federal Government must coordinate the distribution and availability of such units.

Chang stresses also that there’s no place for racial profiling when it comes to housing. Whoever deserves a house must get a house, he insists.

There’s never a wrong time to buy property but one must balance the risk of buying with renting, he advices. Owning a house is riskier as buyers take on enormous debts, sign multi-year loan agreements and become responsible for homeowner costs, he cautions.

“Flip through the newspapers – you’ll see many proclamations of sales of units for public auction that are below RM50,000. Some even dip below RM10,000. On bank websites, you’ll find property foreclosure cases.”

A list of properties put up for auction by CIMB bank showed 35 units in Selangor at reserved prices of less than RM42,000 – that’s the price of a new low-cost unit, notes Chang.

Low-cost units auctioned off for half of the purchase price is an alarming trend, he says. Unfortunately, there aren’t any official statistics on how many low income earners have lost their homes or are struggling with their monthly loan commitment. Where do these homeowners and their families end up living, Chang wonders.

Foreclosures can devastate a family’s economic and social standing, possibly leaving them poorer than before they bought the property. Financiers, local authorities and communities benefit from homeowners being better informed of their rights and responsibilities as borrowers. Ensuring that lower income households have sufficient personal financial management skills and support is crucial.

It’s not enough just to provide homes for the low- and medium-income group. Chang recommends that a homeownership education programme be set up to raise financial literacy and prepare households for the responsibilities of owning a home.

“Manuals, advice or information given via telephone, workshops or counselling to help households maintain their homes and manage their finances must be given before first-time buyers sign the sale and purchase agreement. Public housing schemes are only successful if buyers can hold on to their property.”

Specifically, Chang says education should cover:

> Pre-purchase period – understanding the various types of available housing, the process of buying a house, loan process, and financial preparation needed; and evaluating household needs.

> Post-purchase period – budgeting monthly expenses; making payments promptly; avoiding loan defaults; living within a community; social responsibility; property taxes, assessments, insurance, service charges and sinking fund; home maintenance; and handling problems with the property.

Educate yourself and learn from the mistakes of others to avoid being disappointed or, worse, becoming “house poor” (when most of your income goes towards home ownership), Chang advises. Aspiring buyers must get something that’s within their budget. It could be an older or smaller unit but start small and slowly increase your property portfolio, he says.

“Don’t let friends or family influence you into getting something that’s above your budget, as home ownership is a long term investment. You must be able to service the loan while maintaining an acceptable standard of living.”

The majority may prefer to rent while waiting for the market to soften but it’s better to have your own shelter, says HBA consultant Wong.

The average Malaysian, he insists, can still own property. Consider buying at auctions. Research is a must, though, as inspections aren’t allowed at auctions. It’s an “as is, where is” bid, he stresses. Find out about the surrounding units and the neighbourhood, he suggests.

Better to own but...

PROPERTY investment helps maintain our socioeconomic well-being and must be encouraged, says Datuk Seri F.D. Iskandar, president of the Real Estate and Housing Developers Association Malaysia (Rehda).

Property – a wealth-creation instrument without the volatility of stock markets – has consistently out-performed traditional investment options like bonds, he points out.

But to invest, one must study the property and its market potential. With the right location and strategy, property can be a very profitable investment. The value will appreciate over time, he says.

To many, the most important aspect of owning property is to secure a home. In current conditions, most developers are coming up with attractive packages to close the deal, so it’s a good time to buy. Securing a bank loan now, though, is one of the biggest barriers, he says.

Rehda’s recommendations to the Government and Bank Negara are:

> Encourage innovative home financing packages like the developers interest bearing scheme (better known as DIBS).

> Allow flexible or accelerated tiered payments (longer loan tenure so you pay less now but more later when your salary has increased).

> Relax loan approval criteria with higher financing margins (up to 100%).

Also, banks, he says, shouldn’t just focus on a loan applicant’s current net income; future prospects of higher salaries and other incomes and bonuses must be taken into account.

He dismisses talk that the average Malaysian has been priced out of owning his or her first home.

There’s still a range of prices and options in both the primary and secondary property markets, he says.

With new launches, developers usually offer special incentives, rebates or discounts that will help buyers reduce their initial payment. In the secondary market, however, what you see is what you get. Depending on what you’re looking for, factors like location, surroundings, facilities, transportation and infrastructure will help you decide.

“Property prices in city centres are high because of land value but there are many cheaper options in less-urbanised areas. There are many affordable houses, including those by PR1MA (the 1Malaysia People’s Housing Scheme). The average Malaysian can definitely afford these.

“With an improving transportation system and connectivity, these places are now easily accessible from city centres.”

We are paid enough

WAGES are rising in tandem with the country’s consumer price index (CPI), which is a broad measure of inflation and our productivity.

Both criteria are used to determine wages here, says Datuk Shamsuddin Bardan, executive director of the Malaysian Employers Federation.

While Malaysians lament how their salaries aren’t enough to cope with soaring costs of products and services, their grouses aren’t reflected in the low CPI numbers, he says.

“Measured against the CPI, our average salary growth isn’t lagging. In the region, our salaries are second only to Singapore. Of course, you must consider the currency exchange. Singaporeans earn an average of S$3,000 (RM9,000) while Malaysians take home RM2,800 monthly.

“But bear in mind that the productivity of Singaporeans is 3.8 times higher than ours. Their per unit cost of production per employee is lower than us. In the United States, the productivity level is seven times higher than ours. So when you say we aren’t earning enough, you have to consider our productivity level too,” he states, pointing to how in some of our neighbouring countries, the average salary is less than US$100 (RM400).

However, he acknowledges that houses are beyond the reach of most – and fresh graduates in particular – and adds that even when both husband and wife work, they still may not have enough for the down payment and are forced to rent.

It’s tough, he admits, even for those who have already been working for a decade, to own a house now without financial support from parents.

Related: Renting is OK too

Related Posts:

Feb 29, 2016 ... GEORGE TOWN: Penang has now overtaken the Klang Valley as the most

attractive place for property investment. In its Malaysia Commercial ...

Jun 5, 2016 ... WHILE the property market in Malaysia may be subdued, Penang is still

generating interests among buyers and potential investors.